Bookkeeping Worksheet Sample: A Comprehensive Tool for Your Financial Housekeeping

October 5, 2023

Maximising Your Tax Return Down Under: The Ultimate Checklist

October 9, 2023Introduction: Your Guidepost to Financial Stability and Business Success

In the dynamic landscape of business, mastering the numbers game isn’t just an option; it’s a necessity. Accounting and bookkeeping services stand as the cornerstone of any profitable business, providing the financial clarity and compliance essential for sustained growth. In the era of rapid digitisation and complex tax legislation, these services offer more than just number-crunching; they deliver actionable insights, facilitate strategic planning, and safeguard your business against financial pitfalls.

Navigating the often intricate web of financial responsibilities can be daunting. This is where this blog steps in as your ultimate guide. We will traverse a plethora of topics—covering the exhaustive list of accounting and bookkeeping services to the revolutionary concept of Universal Bookkeeping. We’ll delve into practical tools like bookkeeping worksheets, explore services for specialised industries like childcare and medicine, and even offer pointers on how to find the best local services, whether you’re in Albany, WA or Beckenham.

Ready to solidify your financial foundation and fuel your business growth? Stick around as we decode the complexities of accounting and bookkeeping services, offering you the insider’s guide to financial mastery.

And if you’re keen on bespoke services designed around your unique business needs, don’t hesitate to reach out to industry leaders like Universal Taxation Services. More on how to get in touch with them later in this comprehensive blog. Let’s get started!

The Comprehensive List of Accounting and Bookkeeping Services: Your Roadmap to Financial Success

When it comes to business finances, the devil is in the details. Overlooking even a minor aspect can result in a ripple effect, leading to inefficiencies or, worse, non-compliance. Thankfully, the world of accounting and bookkeeping is rife with services that can cater to every facet of your financial management. Here, we break down the most pivotal services, offering you a panoramic view of options to consider.

Financial Statements & Reporting

In business, knowledge is power, and financial statements are your primary source of financial intelligence. Services in this category offer comprehensive reporting on your business’s financial health, breaking down your cash flows, balance sheets, and income statements, offering you insights that drive informed decision-making.

Tax Preparation & Planning

The end of the financial year shouldn’t catch you off guard. Tax preparation and planning services help you strategise your financial activities to legally minimise tax liability. These services include income tax returns, corporate tax planning, and even inheritance tax plans.

Bookkeeping

Bookkeeping is the unsung hero of accounting. These services maintain meticulous records of financial transactions, from sales and expenses to petty cash. Proper bookkeeping is your first line of defence against financial inconsistencies and non-compliance.

Cloud Accounting

Welcome to the future! Cloud accounting allows you real-time access to your financial data from anywhere in the world. Perfect for businesses that aren’t confined to an office or those who prefer a streamlined, paperless operation.

Budgeting & Forecasting

Having a vision is great, but turning that vision into a reality requires a well-crafted budget and financial forecasts. These services help set financial goals and create actionable plans to achieve them.

Audit & Assurance

These services give you peace of mind by thoroughly examining your financial statements for accuracy and compliance. They can be internal or external audits, providing an independent opinion on your financial standings.

Management Accounting

Management accounting goes beyond the numbers to offer insights on business performance and strategy. It involves analysing financial data to guide corporate decisions, from cost management to pricing strategies.

Business Advisory

Sometimes, you need more than just number-crunching; you need strategic advice. Business advisory services help you understand market conditions, business risks, and opportunities to make better-informed decisions.

Self-Managed Superannuation Funds (SMSF)

For Australians looking to take control of their retirement funds, SMSFs offer an attractive option. These services help you set up and manage your own super fund, offering you greater control over your investment choices.

Virtual CFO Services

Not all businesses can afford a full-time Chief Financial Officer, but that doesn’t mean you have to go without. Virtual CFO services offer high-level financial management and strategy on a part-time or contractual basis.

So, there you have it—a comprehensive list of accounting and bookkeeping services to guide your business to financial stability and success. And if you’re wondering where to find these services under one roof, consider Universal Taxation Services for a tailored experience. On to our next topic!

The Rise of Universal Bookkeeping—A Paradigm Shift in Financial Management

In a world that celebrates specialisation, Universal Bookkeeping emerges as an eclectic powerhouse, capable of servicing a diverse range of industries with equal flair. But what exactly is Universal Bookkeeping, and how does it transform the financial landscape of various sectors, especially in niche areas like childcare and medical bookkeeping?

Definition of Universal Bookkeeping

At its core, Universal Bookkeeping is the philosophy and practice of offering tailor-made bookkeeping solutions that are adaptable across different sectors. It isn’t a one-size-fits-all approach but rather a flexible framework that accommodates the unique financial complexities and compliance standards of various industries.

Benefits of Universal Bookkeeping

Scalability

Universal Bookkeeping grows with your business, easily adapting to new financial challenges and complexities as they emerge.

Consistency

Regardless of your industry, the principles of good bookkeeping remain constant. Universal Bookkeeping ensures that the integrity of your financial management is maintained across different sectors.

Cost-Efficiency

By integrating multiple facets of financial management into a single, adaptable framework, Universal Bookkeeping can offer economies of scale, cutting down your costs in the long run.

How Universal Bookkeeping Caters to Various Industries

Childcare Bookkeeping

Running a childcare centre isn’t child’s play, especially when it comes to finances. From tracking multiple revenue streams to managing government subsidies, the financial landscape is multifaceted. Universal Bookkeeping adapts to these complexities, providing specialised services like fund allocation tracking and expense categorisation to ensure compliance and profitability.

Medical Bookkeeping

The medical industry comes with its own set of financial intricacies, from insurance billing to patient invoicing. Universal Bookkeeping services in this sector focus on compliance with healthcare regulations, proper coding, and billing, while also ensuring that tax deductions specific to medical practices are fully utilised.

In summary, Universal Bookkeeping stands as a game-changer in the financial management sphere. Its adaptability and comprehensive approach make it a go-to solution for businesses across the board, providing an umbrella of services that cater to industry-specific needs.

If you’re intrigued by the promise of Universal Bookkeeping and keen on incorporating it into your own business strategy, consider engaging with an expert team like Universal Taxation Services for a seamless experience tailored to your industry needs.

Stay tuned as we dive deeper into more financial tools and services in the upcoming sections.

The Utility of a Bookkeeping Worksheet—Your Financial Spreadsheet for Success

If bookkeeping is the bedrock of effective financial management, then a bookkeeping worksheet is the chisel that sculpts that bedrock into a masterpiece. Often underestimated, these humble worksheets are the silent workhorses that bring order to the chaos, ensuring that every dollar and cent is accounted for. But what is a bookkeeping worksheet, and how do practice worksheets elevate your financial management to the next level?

What is a Bookkeeping Worksheet?

A bookkeeping worksheet is essentially a financial template that facilitates the systematic recording and organisation of financial data. Think of it as a ledger on steroids. It’s more than just a tabulation of numbers; it’s a strategic tool that can be customised to mirror your business’s unique financial processes. It usually comprises different sections for income, expenses, assets, liabilities, and equity, each meticulously designed to capture every financial nuance.

Bookkeeping Worksheet Sample for [Your Business Name]

Financial Period: [Month/Quarter/Year]

Income

| Date | Customer | Invoice Number | Amount ($) | Payment Received ($) | Outstanding Balance ($) |

|---|---|---|---|---|---|

| 01/01/20XX | Business A | IN001 | 1,000 | 1,000 | 0 |

| 05/01/20XX | Business B | IN002 | 2,000 | 1,500 | 500 |

|---|---|---|---|---|---|

| Totals | 3,000 | 2,500 | 500 |

Expenses

| Date | Vendor | Receipt Number | Category | Amount ($) |

|---|---|---|---|---|

| 01/01/20XX | Supplier A | RC001 | Supplies | 300 |

| 03/01/20XX | Supplier B | RC002 | Utilities | 200 |

|---|---|---|---|---|

| Totals | 500 |

Payroll

| Date | Employee | Gross Pay ($) | Tax Withheld ($) | Net Pay ($) |

|---|---|---|---|---|

| 15/01/20XX | Employee A | 3,000 | 600 | 2,400 |

| 15/01/20XX | Employee B | 2,500 | 500 | 2,000 |

|---|---|---|---|---|

| Totals | 5,500 | 1,100 | 4,400 |

Bank Reconciliation

| Date | Description | Debit ($) | Credit ($) | Bank Balance ($) |

|---|---|---|---|---|

| 01/01/20XX | Opening Balance | – | – | 10,000 |

| 05/01/20XX | Payment to A | 1,000 | – | 9,000 |

|---|---|---|---|---|

| Totals | 1,000 | – | 9,000 |

Accounts Receivable & Payable

| Type | Due Date | Party | Amount ($) |

|---|---|---|---|

| Receivable | 15/01/20XX | Business B | 500 |

| Payable | 20/01/20XX | Supplier C | 300 |

|---|---|---|---|

| Totals | 800 |

The Role of Bookkeeping Practice Worksheets in Streamlining Financial Management

Accuracy

Practice makes perfect, and bookkeeping practice worksheets are no different. By routinely populating these templates, you not only ensure that data is captured accurately but also identify potential areas of financial leakage or misallocation.

Time-Efficiency

The structured nature of a bookkeeping worksheet means that once you get the hang of it, the time you spend on financial record-keeping reduces dramatically. Instead of scrambling through piles of invoices and receipts, you have all the relevant information in one consolidated space.

Audit-Readiness

In the event of an internal or external audit, a well-maintained bookkeeping worksheet serves as your first line of defence. It provides an auditable trail of all financial transactions, making the audit process more straightforward and less stressful.

Decision-making

A comprehensive bookkeeping worksheet offers a panoramic view of your financial landscape, empowering you to make data-driven decisions. From identifying high-performing income streams to flagging unsustainable expenses, the insights are invaluable.

Training Tool

For businesses that are large enough to have a financial team, bookkeeping practice worksheets serve as excellent training tools. They offer a structured format for newcomers to learn the intricacies of financial management, ensuring uniformity and compliance across the board.

In essence, the bookkeeping worksheet is your unsung hero, quietly yet effectively optimising your financial management processes. And if you’re on the lookout for professional assistance to get this set up, Universal Taxation Services has got you covered, offering bespoke financial services that align with your business objectives.

Up next, we’ll discuss how to find bookkeeping services that fit your needs like a glove, whether you’re based in Albany, WA, Beckenham, or anywhere in between. Stay tuned!

Localised Bookkeeping Services—Finding Your Financial Guardians Close to Home

Localisation is more than just a buzzword; it’s a business strategy that can catapult your financial management to new heights. Opting for localised bookkeeping services comes with myriad benefits, from understanding local tax nuances to providing easily accessible, in-person consultations. In this section, we’ll take a virtual tour across different regions—from Albany, WA to Beckenham—to explore how you can find a local bookkeeping service that checks all your boxes.

Bookkeeping Albany WA

If you’re doing business in the beautiful region of Albany, WA, you’ll find that local bookkeeping services here are second to none. These experts understand the local business landscape and are well-versed in regional regulations, ensuring your books are not just balanced but also compliant.

Bookkeeping & Tax Services Perth

Perth, the vibrant capital city of Western Australia, is a hub for businesses big and small. Given its commercial significance, bookkeeping and tax services here are tailored to meet the unique demands of a diverse clientele, from mining companies to tech startups. Whether it’s complex tax planning or straightforward bookkeeping, Perth has got you covered.

Bookkeeping Services in Beckenham

Located within the Greater London area, Beckenham might be a world away from Western Australia, but the importance of localised bookkeeping services remains unchanged. Firms here specialise in catering to the local market, understanding the intricacies of UK tax law, and offering personalised services that can make your financial management hassle-free.

Finding a Bookkeeping Service Near Me

Google is your best friend when it comes to finding local bookkeeping services. Simply type “Bookkeeping services near me” into your search bar, and you’ll be presented with a list of potential partners. But don’t just stop there—make sure to read reviews, compare quotes, and perhaps most importantly, arrange consultations to find a firm that aligns with your needs.

Bookkeeping Services for Small Business Near Me

If you’re running a small business, your bookkeeping needs will differ significantly from those of a large corporation. Thankfully, many local bookkeeping services specialise in catering to small businesses, offering flexible, scalable solutions that grow as you do. To find these, refine your search to include “small business” to find services that match your specific requirements.

Finding a local bookkeeping service can be a game-changer for your business. If you’re looking for a one-stop-shop for a myriad of accounting and bookkeeping services, don’t forget to consider Universal Taxation Services. With offices in Cannington, Ellenbrook, and Gosnells, they offer a wide range of tailored services that can meet the needs of businesses across different sectors and sizes.

Up next, we’ll delve into sector-specific bookkeeping services, exploring how industries like childcare and medicine benefit from tailored financial management solutions. Stay tuned!

Business Plans, Franchises, and Specialised Industries—Your Roadmap to Financial Mastery

As your business evolves, so do your financial needs. Whether you’re plotting out a robust business plan, franchising your successful brand, or running a specialised operation like a childcare centre or medical practice, each of these scenarios requires a unique approach to bookkeeping and financial management. Let’s unpack these one at a time.

Bookkeeping Services Business Plan

A well-crafted business plan isn’t just your ticket to securing investors; it’s also your financial compass, guiding you through each stage of business growth. And right at its core lies bookkeeping. Crafting a bookkeeping services business plan helps you anticipate costs, project revenues, and define clear financial goals, making it an indispensable tool for any entrepreneur.

Franchise Bookkeeping

Franchising offers the allure of rapid expansion, but it also presents unique financial challenges. From tracking royalties to managing multiple revenue streams, franchise bookkeeping is a complex affair. Specialised franchise bookkeeping services offer systems that can be replicated across each franchise unit, ensuring uniformity and simplifying financial management.

Payroll and Bookkeeping Services Near Me

Payroll is often the single largest expense for a business, making its effective management vital. Combining payroll and bookkeeping services can offer streamlined financial management solutions, ensuring seamless payroll processing and meticulous financial recording. Local providers often offer these bundled services, so a simple search for “Payroll and Bookkeeping Services Near Me” could yield impressive results.

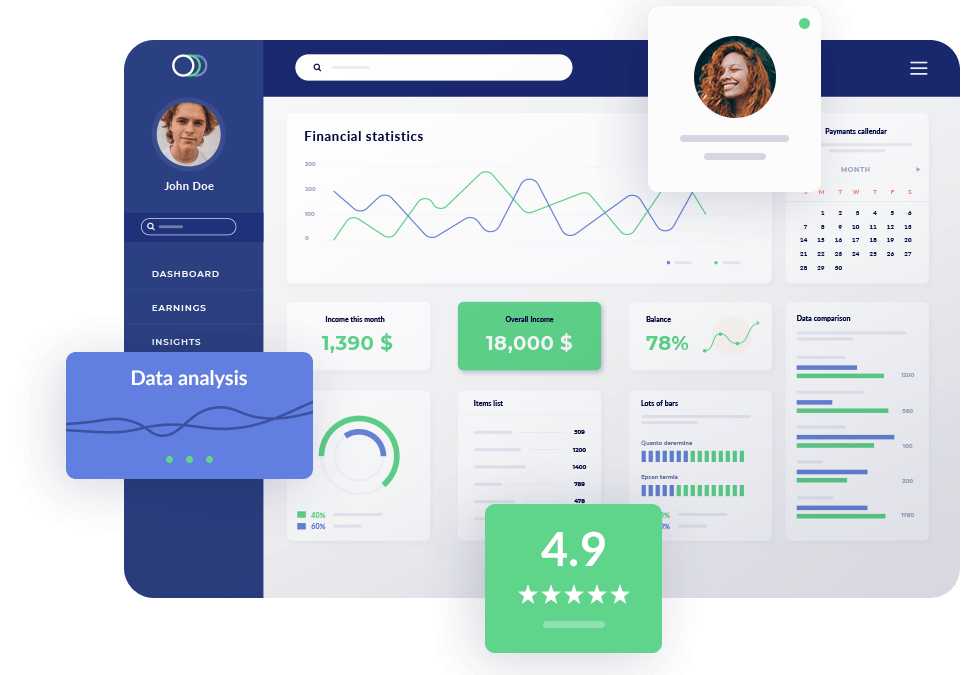

5-Star Bookkeeping

Excellence in bookkeeping is non-negotiable. 5-Star Bookkeeping services go above and beyond, offering premier services like real-time financial tracking, advanced tax planning, and expert financial consultations. Such top-tier services are usually validated by outstanding client reviews and industry accolades.

Childcare Bookkeeping

Childcare is a high-responsibility, high-compliance industry. Specialised bookkeeping services in this sector often include tracking of government subsidies, payroll management for staff, and ensuring compliance with stringent regulations. Effective bookkeeping here ensures that funds are aptly allocated and financial health is diligently maintained.

Medical Bookkeeping

With its unique billing processes, varying patient demographics, and stringent compliance requirements, medical bookkeeping is in a league of its own. From properly coding treatments to making sense of insurance payouts, specialized bookkeeping services in this field ensure that your practice remains both profitable and compliant.

For those seeking exceptional, sector-specific bookkeeping services, Universal Taxation Services is an ideal partner. They bring in-depth knowledge, cutting-edge technology, and a rich array of services to the table, making financial management an effortless affair.

In our next section, we’ll explore the exciting world of digital bookkeeping services, revealing how technology is revolutionising this age-old practice. Keep an eye out!

Types of Bookkeeping Support—A Spectrum of Services to Match Your Business Ambitions

Gone are the days when bookkeeping was a one-size-fits-all proposition. Today, it’s an expansive discipline that adapts to the unique contours of your business, no matter its size, industry, or location. In this segment, we’re spotlighting various types of bookkeeping support designed to meet your diversified business needs.

Small Business Bookkeeping Services

Running a small business? Then you know that wearing many hats is par for the course. However, effective bookkeeping is a specialist skill that demands time and attention. This is where small business bookkeeping services come into play. Tailored to meet the needs of smaller operations, these services offer scalable solutions that can adapt as your business grows, taking the financial management burden off your shoulders.

Dayton Bookkeeping Services

For businesses operating in and around Dayton, location-specific services offer a multitude of advantages. These providers understand the local tax environment and can provide in-person consultations, offering the kind of personalised service that only a local firm can deliver. It’s like having a financial ally right in your neighbourhood.

Payroll and Bookkeeping Services

Combining payroll and bookkeeping services is like hitting two birds with one stone. Not only do you get meticulous record-keeping, but you also benefit from seamless payroll management. Providers offering this integrated service often utilise advanced software solutions that ensure error-free calculations and timely payments, adding another layer of efficiency to your business operations.

Bookkeeping Support for Diverse Business Needs

Every business is a unique entity with its own set of challenges and opportunities. Whether you’re running a high-tech startup, a busy restaurant, or a bustling online store, your bookkeeping needs will be diverse. Specialised bookkeeping services exist to cater to these diverse requirements, offering industry-specific solutions like inventory management, cost accounting, or eCommerce reconciliation.

In the quest for reliable and robust bookkeeping support, consider partnering with a multifaceted provider like Universal Taxation Services. With a broad range of tailored solutions and offices conveniently located in Cannington, Ellenbrook, and Gosnells, they’re well-equipped to handle the financial complexities of any business, big or small.

In our concluding section, we’ll delve into the intricate yet intriguing topic of how bookkeeping and accounting differ and why understanding this difference is pivotal for your financial literacy. Stay with us!

The Bookkeeping Business Landscape—Navigating the Intricacies of Financial Management

The financial ecosystem of any business is a complex web of transactions, compliance, and strategic planning. Often, the terms ‘bookkeeping’ and ‘accounting’ are used interchangeably, but understanding the nuanced differences can be crucial for effective financial management. Let’s dissect the landscape, shall we?

Bookkeeping Accounting

Bookkeeping accounting is a term that encapsulates the essentials of financial recording. It’s all about the diligent tracking of income, expenses, and transactions. While it may not involve the high-level financial analysis that accounting does, it lays the crucial groundwork upon which effective accounting can happen.

Bookkeeping and Accounting Services

While bookkeeping is primarily concerned with recording financial transactions, accounting goes several steps further to include interpretation, classification, analysis, and financial statement preparation. Firms offering both bookkeeping and accounting services provide a comprehensive financial management solution, encompassing everything from basic data entry to complex financial analysis.

Bookkeeping Firms Near Me

Location, location, location—it’s not just a real estate mantra. Finding a local bookkeeping firm can be a tremendous asset to your business. Not only does it facilitate easier communication, but local firms are also more attuned to regional tax codes and regulations. A quick online search for “Bookkeeping Firms Near Me” can often yield a goldmine of potential partners.

The Difference Between Bookkeeping and Accounting

While bookkeeping and accounting are symbiotic, they are not identical. Bookkeeping is about recording financial transactions meticulously and systematically. Accounting, on the other hand, involves summarising, interpreting, and communicating financial information. Bookkeeping sets the stage, but accounting steals the show with its ability to turn raw data into actionable business insights.

Bookkeeping and Tax Services

Given that both bookkeeping and tax services deal with the financial aspect of a business, they’re often offered in tandem. Combining these services ensures that your records are not only well-maintained but also optimally structured for tax planning and submission, saving you time and potentially reducing your tax liability.

For those who value excellence in financial management, Universal Taxation Services stands as a strong contender. With a portfolio that spans both bookkeeping and accounting services, they’re the go-to resource for businesses seeking a comprehensive, one-stop solution for all their financial needs.

In wrapping up this expansive guide, it’s clear that the world of bookkeeping and accounting is both diverse and specialised, offering a plethora of services designed to cater to a wide range of business needs. Whether you’re just starting out or are a seasoned entrepreneur, aligning yourself with the right financial services can pave the way for sustained business success. Cheers to financial mastery!

Charting Your Course in the Financial Landscape

If there’s one takeaway from this comprehensive guide, it’s that the universe of bookkeeping and accounting services is as diverse as the businesses they serve. From the basics of financial statements and the flexibility of universal bookkeeping to the precision of specialised industry bookkeeping—there’s a solution for every financial challenge. We delved into the utility of bookkeeping worksheets and their role in modern financial management. Additionally, we highlighted the benefits of localised services, making it easier for you to find reliable providers in your vicinity, be it Albany, Perth, or Beckenham.

Choosing the Right Service for Tax Purposes

When it comes to tax planning, accounting, and bookkeeping, your selection should be as personalised as your business needs. Seek out services that not only help you comply with taxation laws but also strategise for optimal tax outcomes. Whether you’re a small business owner or running a large operation, aligning yourself with professionals who understand the nuances of tax law can make all the difference between unnecessary financial stress and robust financial health.

Call to Action: Elevate Your Financial Game with Expert Guidance

You don’t have to navigate this complex financial terrain alone. With seasoned experts and personalised services available at your fingertips, professional help is just a call away. If you’re looking for an all-encompassing financial management solution, consider Universal Taxation Services for their top-tier bookkeeping and accounting services.

Get in touch today!

📞 Phone: (08) 9258 8137

📧 Email: admin@universaltaxation.com.au

🗺️ Locations: Cannington, Ellenbrook, Gosnells

Embark on your financial journey with the backing of experienced professionals. Your business deserves nothing less than financial brilliance—let’s achieve it together!

Cheers to your financial future! 🥂