Creating a Business Plan with Business Plan Cash Flow

November 2, 2023Navigating Australian Taxation: Calculate Tax

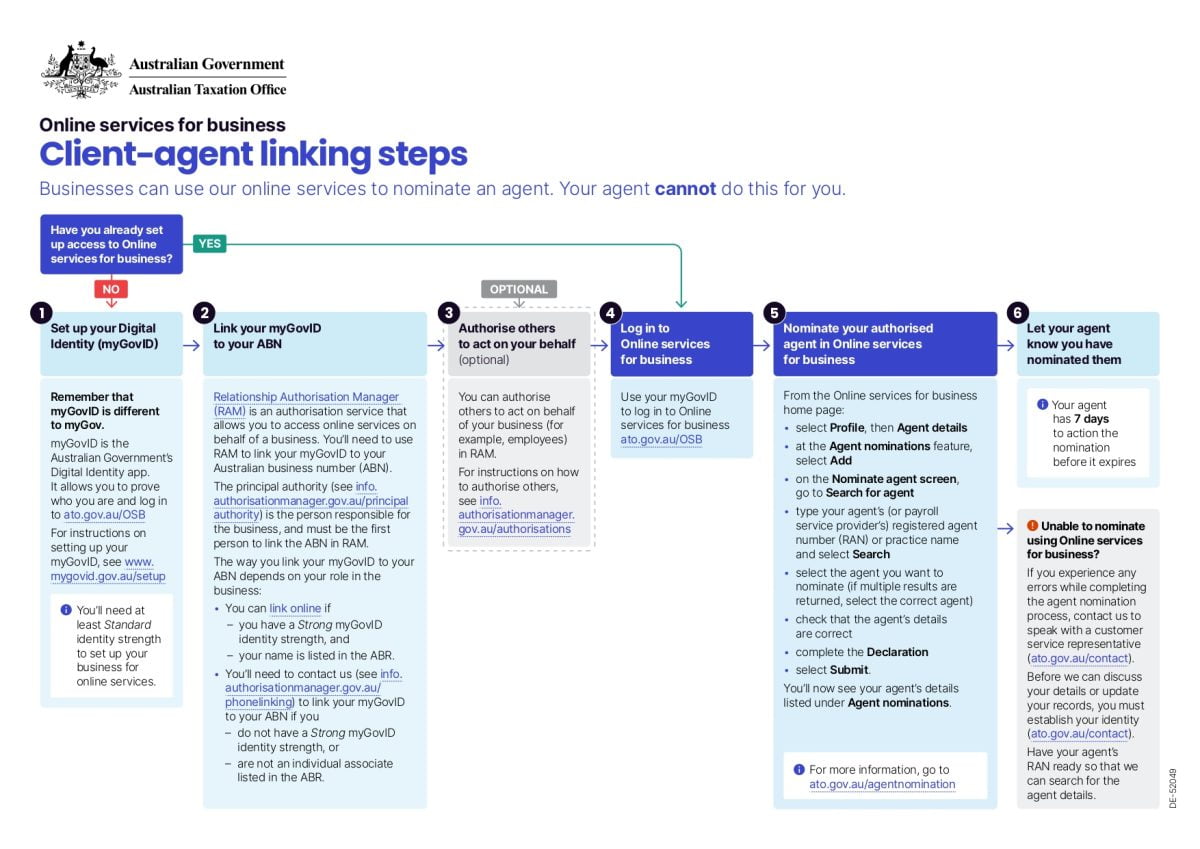

November 27, 2023Effortlessly Nominate [Your Tax Agency Name] as Your Registered Tax Agent. Your agent cannot do this for you. This is mandatory process

Step 1: Begin with Ease

- Navigate to: ATO’s Online Services for Business.

- Action: Log in using your secure myGovID.

- Review ATO guide – https://www.ato.gov.au/Tax-professionals/Digital-services/Online-services-for-agents/Client-to-agent-linking-in-online-services/?=redirected_atoo_AgentnominationsOSFA

Step 2: Quick Selection

- Navigate to: ‘Relationships‘ in the main menu.

- Action: Click on ‘Appoint Someone‘ – your gateway to ease.

Step 3: Detail Input

- Navigate to: Agent nomination.

- Action: Enter our unique registered agent number, available here.

Step 4: Confirmation is Key

- Action: Double-check details for peace of mind and confirm your choice.

Step 5: Seamless Communication, inform us

- Action: Drop us a quick message at admin@universaltaxation.com.au or ring us at (08) 9258 8137.

- Once notified, we will add or update your information in our system within 28 days

Step 6: Relax, We’ve Got This

- Outcome: We’ll promptly update your information, ensuring a smooth transition within 28 days.

Encounter a Hurdle?

- Support is here: Reach out to us at admin@universaltaxation.com.au or ring us at (08) 9258 8137. We’re here to guide every step of the way.

Ensuring Security and Transparency: Understanding the ATO’s Client-to-Agent Linking Process

In an era where financial security is paramount, the Australian Taxation Office (ATO) has introduced a mandatory client-to-agent linking process. This initiative is a crucial step towards safeguarding the integrity of tax management and representation.

What is Client-to-Agent Linking?

This process requires clients to formally nominate their tax agents in the ATO’s Online Services for Business. It’s a significant shift from previous practices, aimed at enhancing the verification of agent-client relationships.

Why Should Clients Comply?

Compliance is not just about adhering to regulations; it’s about ensuring that your financial affairs are in trusted hands. This process confirms that your appointed tax agent is authorized to access your tax records and act on your behalf, minimizing the risk of unauthorized access.

Benefits of the Process

By nominating your agent, you’re taking a proactive step against fraud and identity theft – two rampant issues in the digital age. It also ensures that your sensitive financial data is accessible only to those you’ve explicitly trusted.

The ATO’s Motivation

The ATO’s initiative stems from the need to combat sophisticated criminal attempts to infiltrate the tax system. This measure aligns with global best practices and caters to the heightened community expectations for data security.

How It Helps Clients and Agents

For clients, this process offers peace of mind; for agents, it simplifies compliance and reduces the risk of being inadvertently involved in fraudulent activities. It’s a win-win, enhancing the security of all parties involved.

Conclusion

The ATO’s client-to-agent linking process is a vital step forward in ensuring the security and accuracy of tax-related matters. Embracing this change is essential for maintaining the sanctity of your financial data.